NFC Retries Don't Need Re-Auth Under PSD2

Understanding session-based authentication in contactless payments

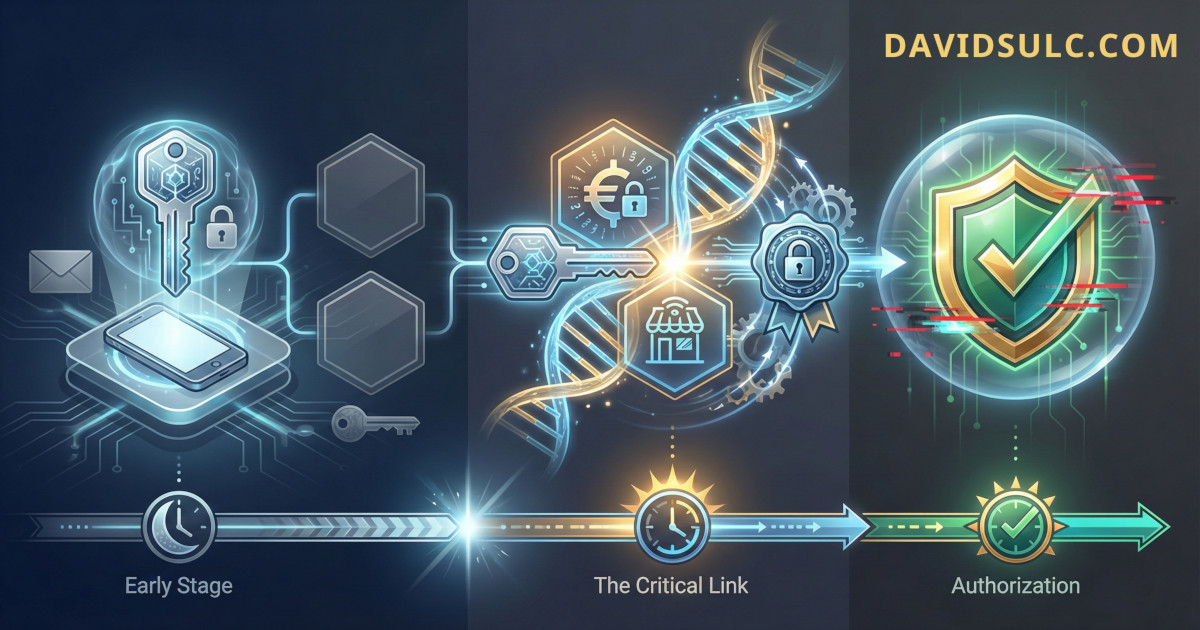

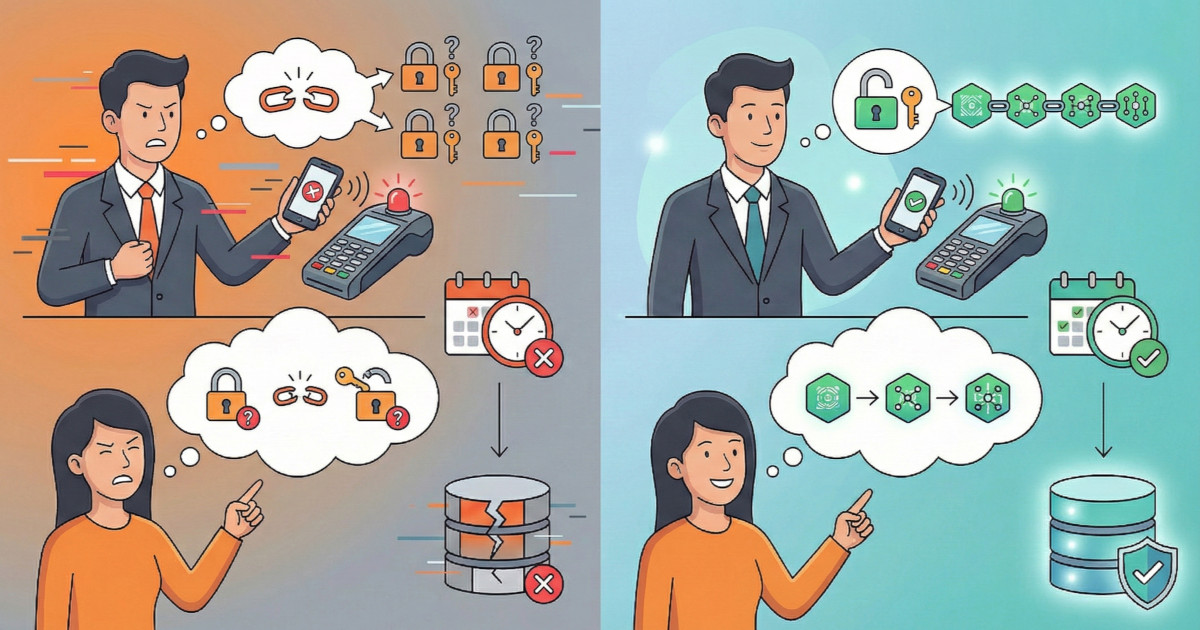

Should users re-authenticate every time an NFC payment fails due to a quick tap? Most assume PSD2 requires it, but the regulations tell a different story. This article breaks down what Strong Customer Authentication actually means for proximity payments, drawing parallels to chip-and-PIN cards and explaining why a single unlock can legitimately cover multiple tap attempts. If you're building mobile payment experiences, understanding this distinction between authentication and authorization could transform your UX without compromising compliance.